April 5, 2017

When you invest in real estate funds, fees matter.

Institutional investors have been focused on real estate since the early 1970s, a time when many factors converged that compelled institutional investors, particularly pension funds, to begin investing in the asset class. The first real estate commingled fund was offered in 1968, and with the passage of ERISA in the United States in 1974, pension investors mandated diversification across asset classes[1]. Endowments and foundations soon followed. Insurance companies, on the other hand, have been investing in real estate since the late 19th century.

Transparency has always been a desirable attribute in investments, but it has been elusive for most institutional investors. Post Financial Crisis, however, legislation has gradually made it more and more difficult to conceal clearly-defined fees from investors and their constituents. MiFID II (UK)[2] and ERISA (US)[3] have put an increasing onus on institutional investors to verify and compare fees to select the most appropriate investment for their respective needs.

One of the cases that has heightened concern amongst institutional investors is a class action against Anthem Inc. where it is alleged that the fiduciaries of the $5.1bn 401(k) plan failed to supply requested information and did not make a reasonable effort to reduce fees (among many other items). Lawsuits such as this have made institutional investors hypersensitive to fees and returns associated with high fees. The most visible example of this sensitivity was seen when CalPERS divested from hedge funds in 2014. Other notable lawsuits involve industry heavy-weights TIAA, CVS, Eli Lilly, Novo Nordisk, and Sanofi-Aventis[4].

As active equity and fixed income managers increase transparency and disclosures, real estate has remained esoteric and fees remain hidden in LP or REIT structures where it is unclear what the total fee load is. Estimates range as high as 8%[5] and if these fees are not baked-in to asset allocation studies then institutional investors could find themselves misallocating assets to investments that underperform their respective objectives.

The types of fees

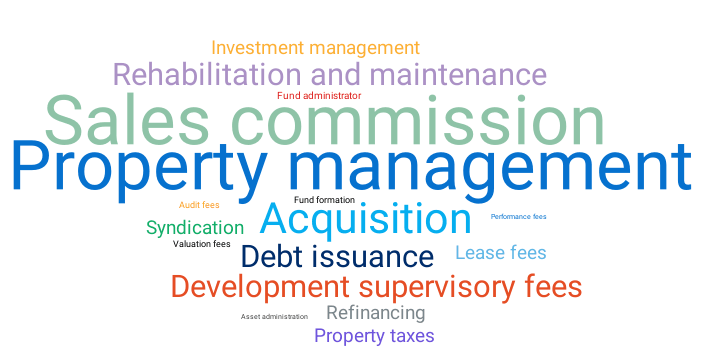

When looking at commercial or residential real estate, there are many kinds of fees that are not immediately discernable to an institutional investor. As an example, a fund that owns single-family homes for rent is likely to be exposed to the following fees (the size of the words indicates the impact of that expense to fund returns).

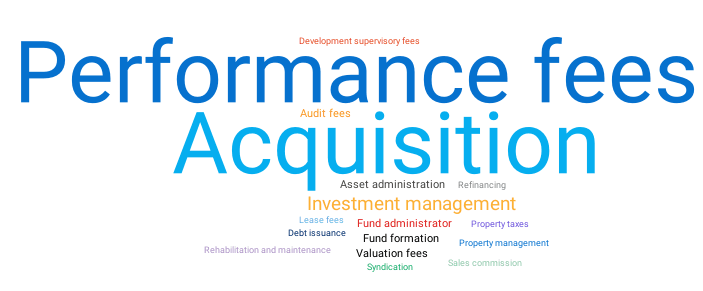

In contrast, with a real estate equity investment, such as those originated by Unison, typical fees would involve the following (the size of the words indicate the degree to which that expense impacts fund returns).

All other costs are borne by the homeowner which makes a home equity investment a very efficient way to participate in home price appreciation (HPA) without having to deal with the cost and complications of generating rental income.

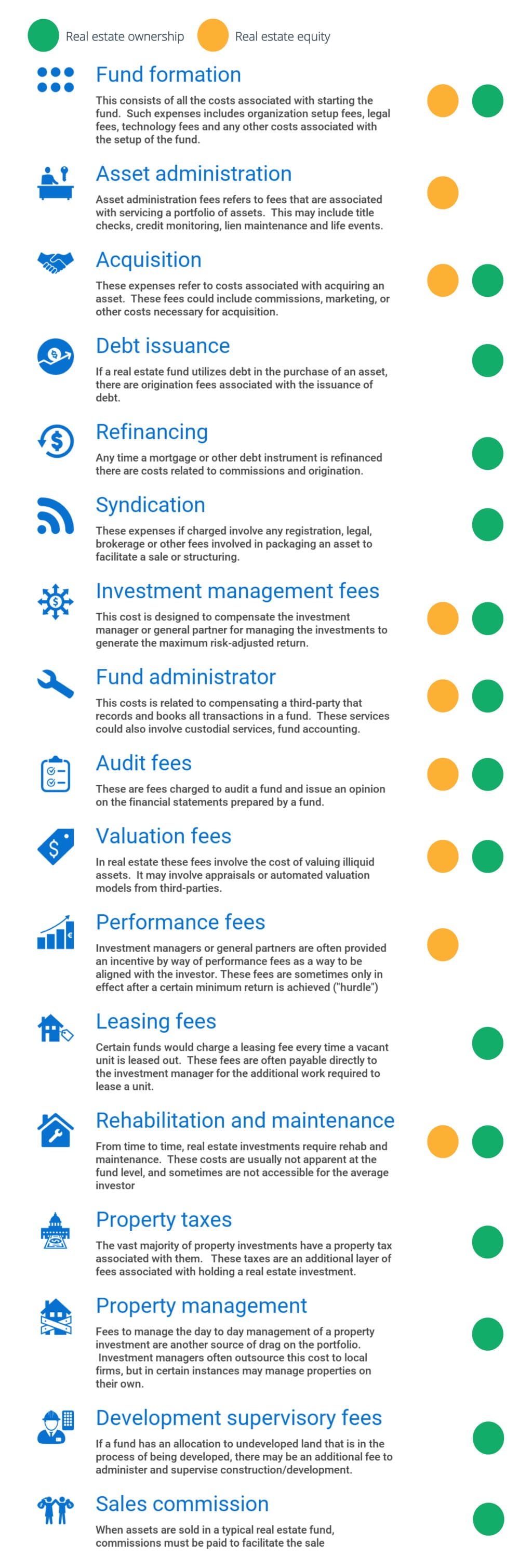

The fees that are likely to be charged in both regular real estate funds and a home equity fund are laid out below, along with which type of product the fees tend to apply to. For the purposes of this article, ordinary real estate funds are referred to as ‘real estate ownership’ and home equity investments are referred to as ‘real estate equity.’

An example of how this plays out

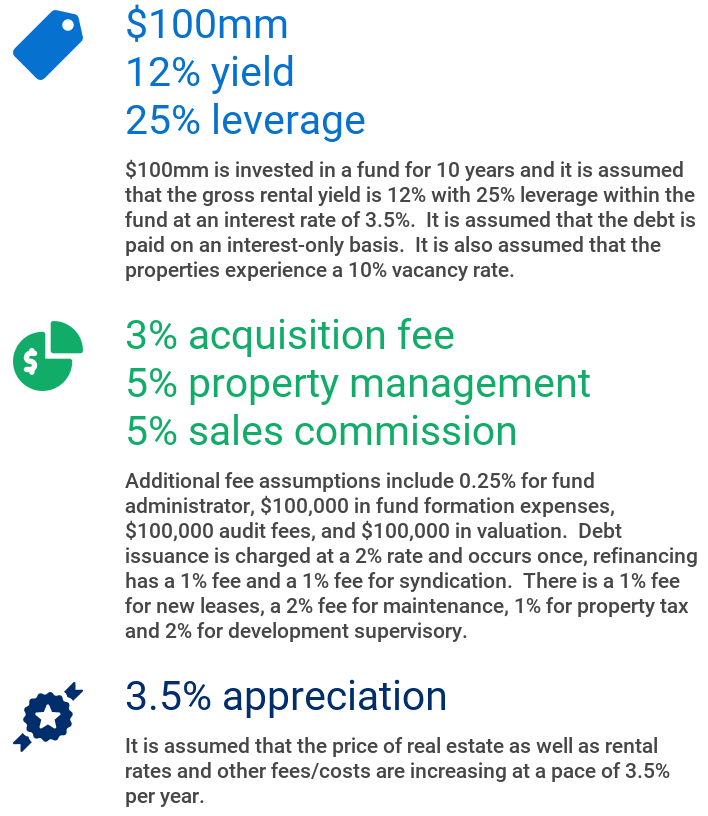

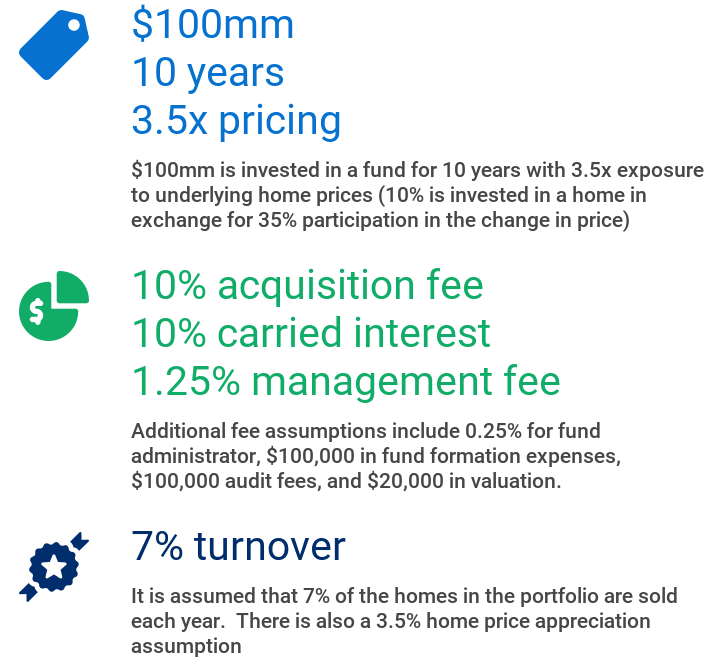

The impact of hidden fees is meaningful. To illustrate the impact of all these fees on the net return (actual return) an investor would experience, we have created two hypothetical funds, using the assumptions shown below. The real estate equity fund is not intended to reflect Unison’s past or future performance. It is intended to illustrate the complexity associated with fees.

Real estate ownership fund

Real estate equity fund

These assumptions are simplistic but provide a reasonably accurate representation of the differences in costs associated with managing a fund that owns residential real estate assets and rents them out versus a fund that owns leveraged exposure to the equity in residential real estate[6].

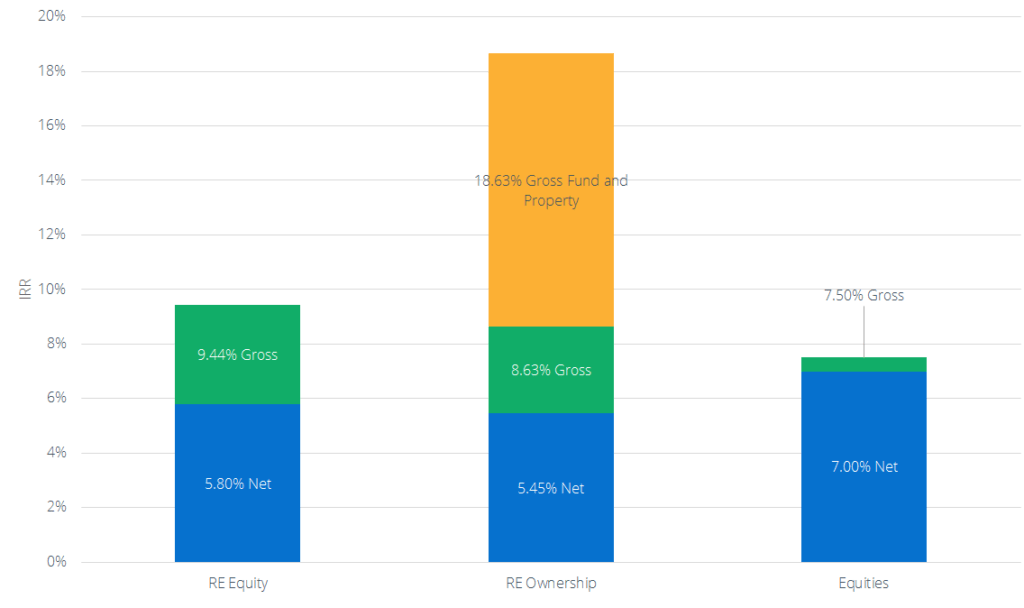

Real estate generates a significant difference between gross and net IRR, particularly when compared to another efficient, liquid asset class such as equities. A real estate equity fund is expected to experience a higher net IRR than a typical real estate ownership fund, despite assuming an embedded performance fee, a higher acquisition fee (10% vs. 3%), and no cashflow from leasing out assets. The primary reason for this is the leveraged exposure to HPA. The key message for an investor in a fund that owns and leases real estate is that the difference between owning an asset and collecting rents compared to what is experienced in the fund is material (18.6% gross compared to 8.6% after accounting for property-level expenses and then 5.5% after adjusting for fund-level expenses)[7].

Real estate generates a significant difference between gross and net IRR, particularly when compared to another efficient, liquid asset class such as equities. A real estate equity fund is expected to experience a higher net IRR than a typical real estate ownership fund, despite assuming an embedded performance fee, a higher acquisition fee (10% vs. 3%), and no cashflow from leasing out assets. The primary reason for this is the leveraged exposure to HPA. The key message for an investor in a fund that owns and leases real estate is that the difference between owning an asset and collecting rents compared to what is experienced in the fund is material (18.6% gross compared to 8.6% after accounting for property-level expenses and then 5.5% after adjusting for fund-level expenses)[7].This is not to say that investing in a real estate fund that owns and leases properties is a bad investment. What it does suggest is that these returns should be appropriately calibrated in any asset allocation study, where real estate’s risk/return characteristics are appropriately reflected.

Conclusion

As an institutional investor, ignoring fees beyond what is immediately apparent (investment management fee, audit fee) is not possible anymore. Negligence here results in a significant liability for all institutional investment fiduciaries. It is prudent to either monitor fees for reasonableness internally or to use one of the many firms that offer these services.[8]For several reasons, real estate is a desirable asset for institutional investors, but failing to look at it on a net basis results in limited utility from asset allocation studies which desire real estate for its low correlation with other asset classes, low volatility, and seemingly strong cashflow characteristics[9]. In fact, asset allocation studies often have a subjective limit on the allocation to real estate that is imposed to stop the model from allocating too much of a portfolio to the asset class. These subjective constraints would to some degree be obviated if net IRRs were used rather than gross IRRs.

Real estate investment opportunities that reduce the potential for fees to chip away at returns should be considered as an attractive method to avoid the risk that fees and costs associated with maintaining assets erode returns (fees such as leasing fees, maintenance/repair, property taxes, vacancies etc.). The rationale for investing in real estate is likely to be explored further in subsequent blog posts.

As always, if you have any questions, comments, or concerns, please contact us at [email protected].

[1]The Evolution of Pension Fund Investment in Real Estate. 1990. Ellen Beckett Brown. MIT

[2] The Markets in Financial Instruments Directive is the EU legislation that regulates firms who provide services to clients linked to ‘financial instruments’ (shares, bonds, units in collective investment schemes and derivatives), and the venues where those instruments are traded. https://www.fca.org.uk/markets/mifid-ii

[3] The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established pension and health plans in private industry to provide protection for individuals in these plans. https://www.dol.gov/general/topic/health-plans/erisa

[4] http://finance.yahoo.com/news/keller-rohrback-l-l-p-100000671.html

[5] https://www.forbes.com/sites/edwardsiedle/2016/06/16/pensions-unaware-hidden-real-estate-fund-fees-dwarf-disclosed-fees/#3148d76b1961

[6] An example of this product is the Unison HomeBuyer (www.unison.com) which typically invests 10% in the equity of a home in exchange for 35% exposure to the change in price of each home. These investments tend to be originated for a 30-year period.

[7] These examples are hypothetical in nature and only for indicative purposes. Actual results can materially differ.

[8] Firms such as Cambridge Associates, Greenwich Associates, Morningstar, AON Hewitt, Mercer, Towers Watson, bfinance, etc.

[9] AON Hewitt. http://www.aon.com/attachments/human-capital-consulting/Asset-Allocation-through-Changing-Market-Environments.pdf

Contact UnisonIM

For more information, please contact:

Unison Investment Management

650 California Street Suite 1800 San Francisco, CA 94108

Real Estate Equity Exchange, Inc. Copyright 2023

or visit our Contact page

650 California Street San Francisco, CA 94108 | 415-992-4200 | Real Estate Equity Exchange, Inc. Copyright 2023