January 4, 2019

An Asset Class that Deserves a Home: Residential Real Estate

SUMMARY

- Residential real estate is the largest asset class in the world, with a value of $162TRN, and offers strong diversification benefits given its correlation to equities and fixed income of only 0.25 and -0.18, respectively.

- Housing is the largest component of CPI, representing 42% and accounting for more than food, transportation, education, and clothing combined—this makes it an invaluable hedge asset for investors with inflation-exposed liabilities.

- Institutional investors are increasingly using Home Ownership Investments to enable investment in residential real estate.

- Home Ownership Investments are equity investments in individual homes made alongside the owner—they provide an efficient and scalable way to access a diversified housing portfolio.

- Unlike other inflation hedges, such as TIPS, the return potential of these investments is in line with many institutional investors’ nominal and real return objectives.

INTRODUCTION

Institutional asset allocators are balancing competing portfolio objectives in a challenging environment. Low capital market return forecasts are consensus, while return targets remain high. This combination necessitates allocations to asset classes with higher return potential. However, increasing such allocations often runs counter to the need for diversification.In addition, looking at nominal return potential is often insufficient. Many investors also need to hedge inflation. Finally, fiduciaries are under pressure to extract fee transparency from asset managers, despite asset classes with higher return potential often having opaque fee structures.

Against this backdrop, we believe residential real estate and Home Ownership Investments can play a key role in helping institutional investors balance these priorities.

DIVERSIFICATION AND INFLATION-HEDGING POTENTIAL OF RESIDENTIAL REAL ESTATE

Residential real estate as an asset class offers attractive diversification and inflation-hedging potential. A core tenet of portfolio construction is ensuring an economically representative asset allocation. Residential real estate is the largest asset class in the world, with a total value of $162TRN[1]. This compares with $102TRN for fixed income (the second largest). In the US alone, the market value of housing represents $27TRN[2]. From an economic output perspective, housing is the largest component of GDP (for this discussion, we are considering US GDP) at approximately 18%[3]. In addition, US residential real estate has demonstrated low correlations to both equities (0.25) and long-duration fixed income (-0.18)[4]. The average asset allocation for institutional investors demonstrates that these are two key risk factors. Residential real estate is, accordingly, a valuable potential diversifier. In terms of inflation, residential real estate is one of the most attractive structural hedges available. Housing is the largest component of CPI and accounts for more than food, transportation, education, and clothing combined.

In terms of inflation, residential real estate is one of the most attractive structural hedges available. Housing is the largest component of CPI and accounts for more than food, transportation, education, and clothing combined.Inflation is a core risk for many investors. The defined benefit payments made by plan sponsors who provide COLAs (cost of living adjustments) rise with inflation, while defined benefit plan sponsors with active members are typically exposed to changes in salaries, which can also rise with inflation. Accordingly, whether explicitly identified or not, inflation is a core risk factor to be accounted for in a liability-driven investment framework. Building a hedging portfolio to match the duration and curve risk of forecasted nominal liabilities is insufficient.

Turning to endowments and foundations, CIOs typically have inflation as a structural component of their return target (e.g., CPI+5%). In parallel, they often have preserving real value as a formal objective. From a liability perspective, foundation grants and university operating expenses grow with inflation.

Family office CIOs typically have a mandate to preserve and grow intergenerational wealth. Doing so solely in nominal dollar terms is clearly not sufficient. Wealth for the purposes of this mandate must be defined as real purchasing power.

INVESTING IN RESIDENTIAL REAL ESTATE

Getting exposure to this asset class is challenging. Mortgages come with interest rate duration and negative convexity (with respect to both interest rates and home prices). Their limited exposure to the appreciation of underlying homes limits their ability to act as a credible inflation hedge.Another alternative is public or private real estate investment trusts (REITs). However, these are heavily biased towards multi-family properties and are concentrated in specific areas of the United States. Even across different cities, they often focus on the same types of neighborhoods. While the single-family REIT sector is growing, it faces the key challenge of needing to manage, maintain, lease, and potentially evict tenants from individual homes. Fulfilling these duties is inherently more efficient when dealing with a few large multi-family properties, as opposed to many individual homes.

The nature of the homes themselves is also a limitation of single-family REITs. These REITs are restricted to rental properties and will not have exposure to higher-value homes and neighborhoods that are typically owner-occupied.

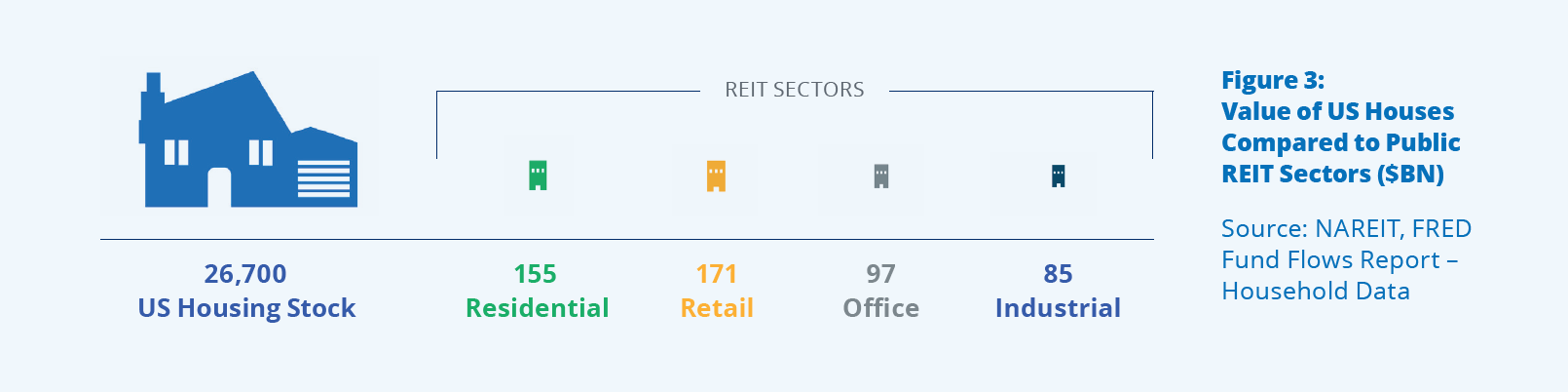

Additionally, public REITs represent an immaterial share of overall housing. Even residential REITs broadly are less than 1% of the size of the US Housing stock. This further illustrates the enormity of the residential real estate asset class, which also dwarfs other public REIT sectors.

Finally, risk management is a challenge for investors in both public and private REITs, but for different reasons. Public REITs, by virtue of being listed equities, trade with substantial equity beta. While they tend to perform similarly to private real estate over the long run, near-term swings with a high correlation to equity markets are undesirable for any investor. Private REITs, on the other hand, exhibit very low volatility. This is driven in large part by the infrequency or poor quality of valuation of the underlying properties.

Finally, risk management is a challenge for investors in both public and private REITs, but for different reasons. Public REITs, by virtue of being listed equities, trade with substantial equity beta. While they tend to perform similarly to private real estate over the long run, near-term swings with a high correlation to equity markets are undesirable for any investor. Private REITs, on the other hand, exhibit very low volatility. This is driven in large part by the infrequency or poor quality of valuation of the underlying properties.

HOME OWNERSHIP INVESTMENTS

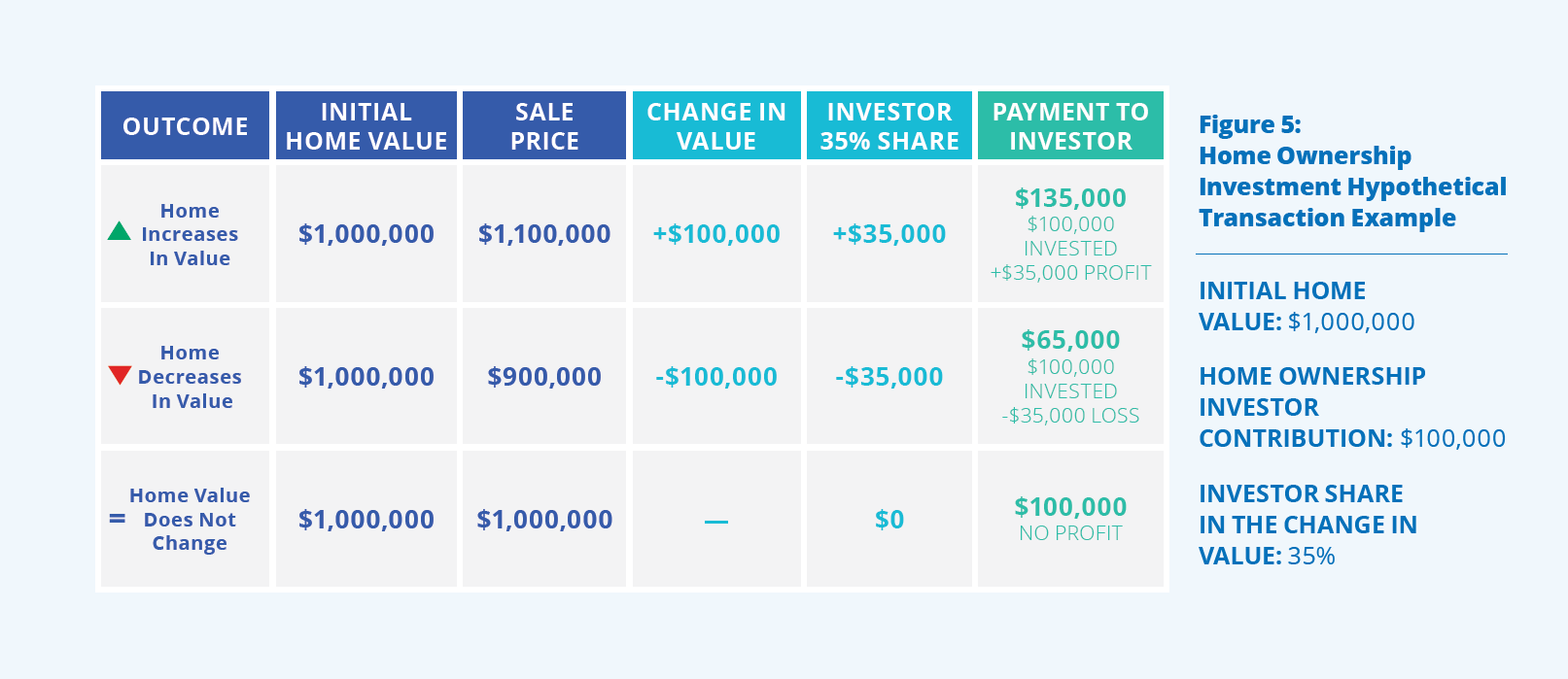

Institutional asset allocators are increasingly using Home Ownership Investments to access residential real estate as an asset class. These equity investments in individual properties are made alongside the homeowner. Existing homeowners can utilize them to realize a portion of their equity without adding debt. For homebuyers, they provide a contribution towards the down payment on a home purchase. In exchange for their investment in a property, the investor shares in the change in value when the property is sold, or when the homeowner buys out the contract. This share in the home value change is typically a multiple of 3 to 4 times the capital invested. An example of such an investment contract is illustrated below.

This share in the home value change is typically a multiple of 3 to 4 times the capital invested. An example of such an investment contract is illustrated below.

This 3 to 4 times exposure to home value changes produces a key feature of these investments: they provide efficient structural leverage to home price appreciation. Given the importance of housing in the inflation basket, this makes Home Ownership Investments an invaluable inflation hedge.

This 3 to 4 times exposure to home value changes produces a key feature of these investments: they provide efficient structural leverage to home price appreciation. Given the importance of housing in the inflation basket, this makes Home Ownership Investments an invaluable inflation hedge.Additionally, the loss to an investor is limited to the initial contribution ($100,000 in the above example). With unlimited upside exposure to housing and restricted downside, these investments effectively represent call options on house prices.

The nature of Home Ownership Investments also makes them scalable. Homeowners themselves are responsible for taking care of the properties. Investors can thus build a portfolio of high-quality homes diversified across geographies, without needing to worry about property management and taxes, tenants, maintenance, evictions, etc. This contrasts with the challenges facing single-family REITs.

For homeowners, these investments are not debt, so do not carry interest and principal payments. They can empower homeowners to optimize their personal financial situations. Homeowners typically have an outsized share of their net worth exposed to the idiosyncratic risk of their individual homes. While the US housing market as a whole has exhibited volatility of under 3%, individual homes show volatility of over 12%. This substantial reduction in volatility is analogous to what one sees when going from holding a single stock to investing in a broad index.

Home Ownership Investments allow home buyers and owners to reduce their exposure to this property-specific risk. Institutional owners of Home Ownership Investments on the other hand can own a broadly diversified portfolio of these individual investments, mitigating the idiosyncratic risk associated with individual houses. By allocating risk more efficiently and reducing systemwide debt, the growth of Home Ownership Investments can play a key role in helping delever the home financing industry.

Home Ownership Investments allow home buyers and owners to reduce their exposure to this property-specific risk. Institutional owners of Home Ownership Investments on the other hand can own a broadly diversified portfolio of these individual investments, mitigating the idiosyncratic risk associated with individual houses. By allocating risk more efficiently and reducing systemwide debt, the growth of Home Ownership Investments can play a key role in helping delever the home financing industry.This reallocation of risk is just one example of the alignment of interests between home ownership investors and individual homeowners. Both win and lose together as equity owners in the home. The homeowner remains incentivized to maximize the value of the property. Also, the manager of Home Ownership Investments is in a unique position to help homeowners when times get tough. In a foreclosure situation, the lender has no incentive to maximize sales price beyond the debt on the property. When the homeowner faces foreclosure, the manager of a home ownership investment can step in to reinstate the mortgage temporarily and allow for an orderly sale that maximizes the value of the homeowners’ equity and the home ownership investment.

From a return potential perspective, Home Ownership Investments can fit squarely with the return targets sought by many institutional investors. Returns on Home Ownership Investments net of fees may be approximated as just over 2x house price appreciation[5]. Combining this with long-run forecasts for US house price appreciation results in a return estimate in line with the 7-8% target for many institutional portfolios.

In addition, while Home Ownership Investments do not generate rental income, this does not mean they do not provide cash flow. Cash flows are generated as individual homes are sold and agreements are bought out by homeowners. At the level of an overall portfolio, cash flows from this turnover can be forecast with surprising accuracy.

In addition, while Home Ownership Investments do not generate rental income, this does not mean they do not provide cash flow. Cash flows are generated as individual homes are sold and agreements are bought out by homeowners. At the level of an overall portfolio, cash flows from this turnover can be forecast with surprising accuracy.Finally, fiduciaries are scrutinizing the fees of different investment structures. Recent lawsuits have made them hypersensitive on this topic[6], and rightfully so. All-in fees for private real estate strategies have been estimated as high as 8%[7]. Compared to other private investment funds, Home Ownership Investment strategies may provide numerous benefits; for example, they avoid property management, leasing, and debt issuance fees. However, the level of fee transparency and availability of investor-friendly structures (e.g., only charging fees on called as opposed to committed capital, providing expense rebates, etc.) comes down to the individual manager.

FINAL THOUGHTS

Representing the largest asset class in the world and the largest individual component of US GDP, residential real estate deserves a key role in institutional asset allocations. Its correlation structure may help diversify the traditional equity and fixed income betas that form the bedrock of most portfolio risk factor profiles. Additionally, housing is a structural component of inflation. It represents over two-fifths of CPI, making it an invaluable inflation hedge for a wide range of institutional investors, especially those with inflation exposure in their liabilities.Finally, Home Ownership Investments are efficient and scalable tools to get exposure to residential real estate, and they are gaining interest among institutional investors. The return potential of these investments can be directly in line with many investors’ targets, while at the same time providing structurally leveraged inflation-hedging potential. In summary, residential real estate accessed through Home Ownership Investments deserves a home in many strategic asset allocations.

[1]$162 trillion value sourced from Value Walk and Bloomberg

[2] Fed Flow of Funds and Urban Institute, Q2 2018

[3] 18% of GDP sourced from BEA

[4] Correlations calculated using data from Bloomberg (date range: 2007 – 2017)

[5] While leverage may initially be 3-4x, representing the investor’s share of the home value change, like any call option, the leverage declines over time as the underlying asset (the home) appreciates.

[6] Notable lawsuits involve Anthem Inc, TIAA, CVS, Eli Lilly, Novo Nordisk and Sanofi-Aventis.

[7] https://www.forbes.com/sites/edwardsiedle/2016/06/16/pensions-unaware-hidden-real-estate-fund-fees-dwarf-disclosed-fees/#3148d76b1961

Contact UnisonIM

For more information, please contact:

Unison Investment Management

4 Embarcadero Center, Ste. 710, San Francisco, CA 94111

Real Estate Equity Exchange, Inc. Copyright 2023

or visit our Contact page

©2025 Unison Investment Management, LLC | 4 Embarcadero Center, Ste. 710, San Francisco, CA 94111 | 415-992-4200