The foundation for our future

We are committed to empowering our homeowners in both their homeownership journeys and the larger path to financial wellness as they utilize their equity to erase debt, start small businesses, diversify their portfolios, plan for retirement, and renovate their homes. See our impact in action from Innovate Finance’s 2023 “Wired Differently” series:

In addition, the integration of ESG considerations into our investment management processes helps us best understand investment risks and maximize returns.

In addition, the integration of ESG considerations into our investment management processes helps us best understand investment risks and maximize returns.

A supporter and signatory to

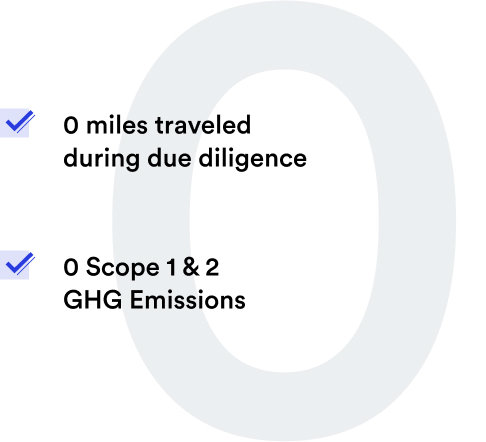

Environmental Integration to asset selection and active management

Unison makes investments based on the belief that the integration of environmental considerations helps us better understand investment risks and maximize long-term investment returns

100%

of investments in urban properties

By deselecting rural properties Unison promotes urbanism and its environmental benefits.

0%

in rural homes

Discouraging suburban sprawl by limiting access to capital for greenfield developments

99.9%

investments in metropolitan areas in 2021

...

0.15%

investments in Non-metropolitan in 2021

...

View full report >

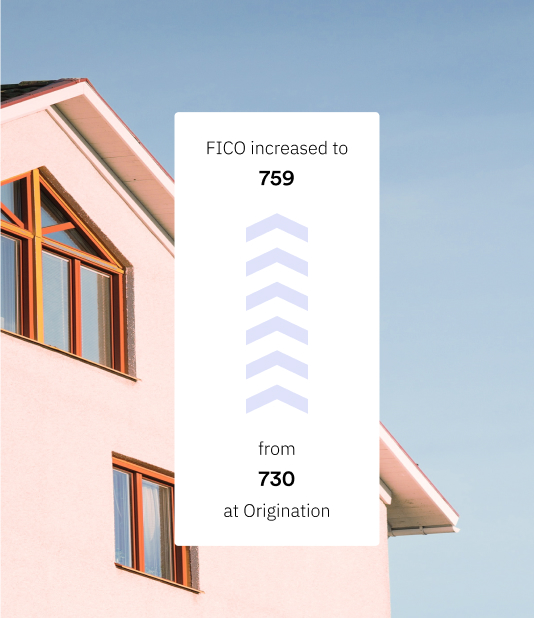

Reducing household debt

With Unison, consumers are able to proactively lower their household debt and improve their financial health, resulting in decreased credit risk which is sustained beyond the immediate impact of reducing balances.

“Housing affordability and lower debt will be central to the prosperity of our communities.”

Thomas Sponholtz

CEO

Unison homeowners can trade their mortgage debt for equity investments and reduce their over- exposure in their home

Unison homeowners can use equity to pay off high interest debt and improve their financial status

Our principles

Integration

We consider and evaluate ESG factors alongside other risk factors in our investment processes because we believe they materially impact the value of our investments.

Active ownership

We are active owners, supporting our homeowner customers to achieve superior ESG outcomes.

Corporate sustainability

We incorporate ESG best practices into our asset management approach and corporate decisions, as well as our investment processes.

Transparency

We are committed to delivering unparalleled transparency to both investors and our homeowner customers.

Thought leadership

We continue to expand our knowledge and evolve our practices to foster a culture of thought leadership and collaboration.

Sustainability Content

Resources

Unison is an engine for social impact. Our investments are designed to solve major socio-economic issues by increasing housing affordability, reducing household debt, and closing the retirement savings gap. Unison includes ESG considerations into our investment management processes and ownership practices, minimizing our impact on the environment and ensuring the sustainability of our investments.

Resources

Unison is an engine for social impact. Our investments are designed to solve major socio-economic issues by increasing housing affordability, reducing household debt, and closing the retirement savings gap. Unison includes ESG considerations into our investment management processes and ownership practices, minimizing our impact on the environment and ensuring the sustainability of our investments.

Contact UnisonIM

For more information, please contact:

Unison Investment Management

4 Embarcadero Center, Ste. 710, San Francisco, CA 94111

Real Estate Equity Exchange, Inc. Copyright 2023

or visit our Contact page

©2025 Unison Investment Management, LLC | 4 Embarcadero Center, Ste. 710, San Francisco, CA 94111 | 415-992-4200